Paying off debt can be such an overwhelming task, I know…tried a few different times before it finally happened. We had about $35,000 in debt when we started this Journey. We had a car loan, student loan, four credit cards and a maxed out credit line! But with some determination we did it and it can happen for you too!

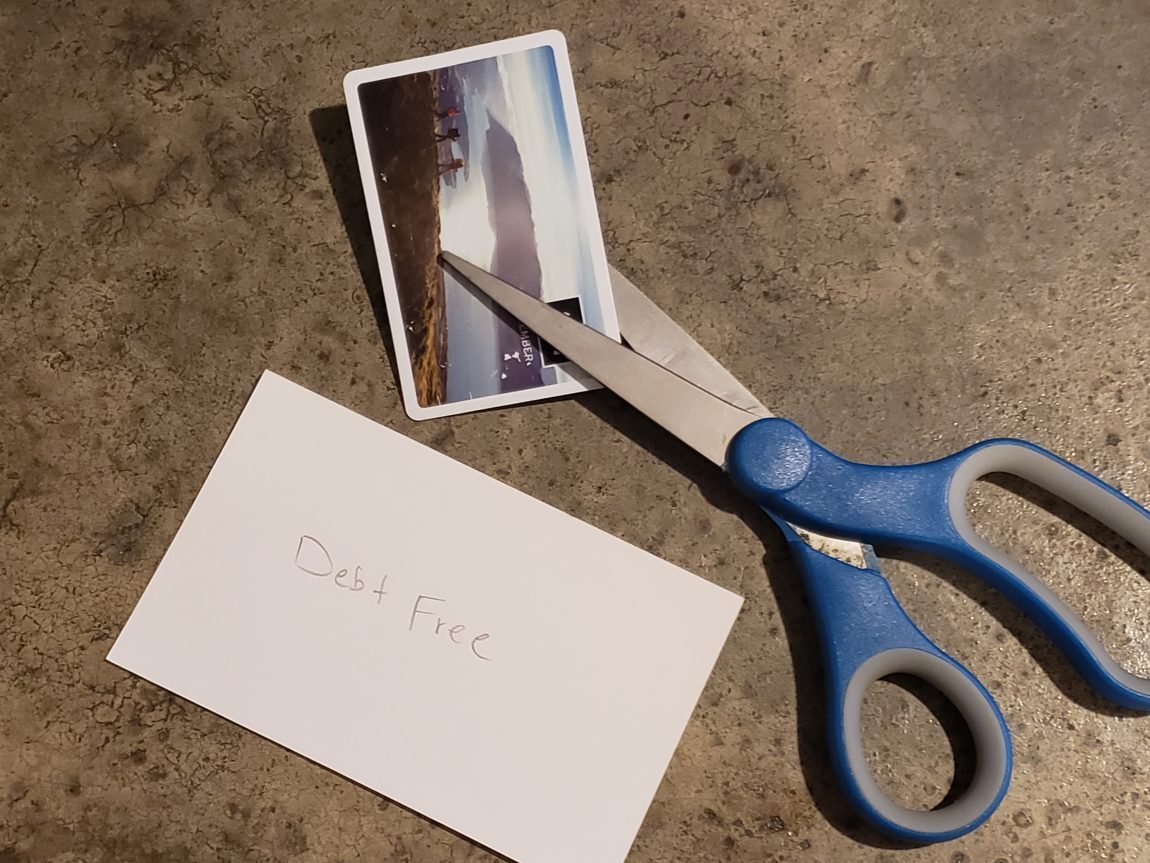

So the first thing that really has to happen is you have to COMMIT! Like REALLY COMMIT! you cant just kinda wanna do it, you have to be ALL in. One way we showed commitment is we immediately cut up all our credit cards so we COULD NOT USE THEM AT ALL.

And the other thing that is just as important as the first…Your significant other or your spouse really needs to be on the same page as you. Let me tell you, its gonna be really difficult to get that credit card paid off if the other half in your house keeps spending money on it.

What got me excited to do this was watching a random YouTube video of the Dave Ramsey show and I thought this was something we really needed to focus on for the rest of 2018. So I sat down with my husband and we decided on what we were willing to sacrifice and what we weren’t to get to our goal. But we stuck to only one thing. We still wanted to feed our family organic foods even though its a pretty hefty price tag. But, to still cut down costs on our high food budget we cut out a lot of snack foods for the kids and cooked at home.

Now, Dave Ramsey wouldn’t tell you to keep eating organic, he would tell you to eat rice and beans. I get that I could have paid things down a little faster so I guess I was not 100% Dave Ramsey style but I did use some of his basic principles. So the first thing we did is make sure that we had a small emergency fund set up so we wouldn’t be tempted to use our cards if something came up. So we started with one thousand dollars. Then after you have your emergency plan in place then we listed all our debts from largest to smallest and put them on a white board where we could see them Every.Single.Day. We would then pay the minimum balance on all of the debts except the smallest debt. The smallest debt we threw any and all extra money we could. I was surprised that this only took us a couple weeks yay! Even though our smallest debt wasn’t necessarily our lowest interest rate, it felt AMAZING to erase one of the debts off the board.

So after, we paid off the smallest debt, we were then able to put the money that we were paying on that debt onto the next smallest debt. So now, you are able to double or triple the amount that you were paying on this debt and now you get this next debt payed off even faster!! This is what Dave Ramsey likes to call the “Debt Snowball.” So by using this method we were able to pay off 3 of 4 credit cards pretty quickly and the student loan, and then next came the car. All of these balances were around 1-3 thousand dollars. The hardest part is when you get to those HIGH balances. We had one credit card over five thousand dollars and our credit line was almost maxed out at 24 thousand dollars!!! EEEKK!!!

So this is when having the debts written on the whiteboard in a visible place comes in handy. We put our white board in our pantry where I could see it every time I went to make a meal for me or the kids, or even if I just went in there to find a snack, it was there staring back at me…mocking me for getting myself into the predicament in the first place. But, this is the best part…Because we had every other debt paid off we had freed up 5oo extra dollars per week to put on this debt! So even though the balance was super high, putting that much on the debt every week made it so I could finally see the number going down, instead of staying maxed out like it had been for the last 3 years or so. We also, tried to celebrate milestones to keep us motivated. like when we got under 15 thousand dollars and then under 10 thousand dollars. We paid the last payment in one big chunk at about four thousand dollars to go, we just wanted to finally get it over with…rip off the last of the band-aid.

We are blessed that we have our own business so we were able to put extra money on the debts during the busy season to get our snowball going quicker, but just stick with it and celebrate those small milestones and don’t give up. One last tip that I have is to send your husband to do the shopping if he is like mine because he only buys whats on the grocery list so there is no impulsive buys. I feel like I saved SO MUCH MONEY by just not going to the store. If I really needed something for me or the kids, I would try to buy it online so I couldn’t impulse shop.

I hope this helps you get and stay motivated on your own DEBT FREE JOURNEY.

No Comments